For any live event ticketing, filling the full capacity of the venue is crtitical part of their business yet pricing options have been limited to simple models such as "early bird discounts" or slashing the ticket price towards the end of the sale.

With the programmable money powered by Ethereum smart contract, we can provide more attractive pricing model which incentivse ticket buyers to coordinate together to fill the venue while minimising the risk of loss for event organisers.

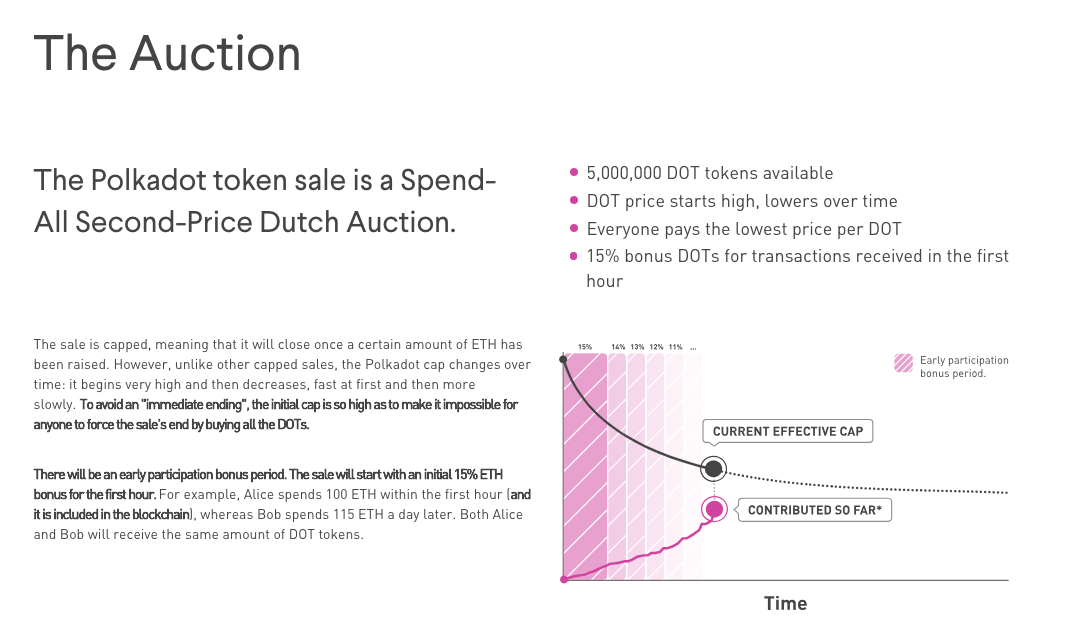

In our project, we will use "Dutch auction model" made popular by a couple of ICOs (such as Gnosis and Polkadot) but will tailor to fill the need for the physical events.

Imagine there is a music band who want to hire a venue for their gig.

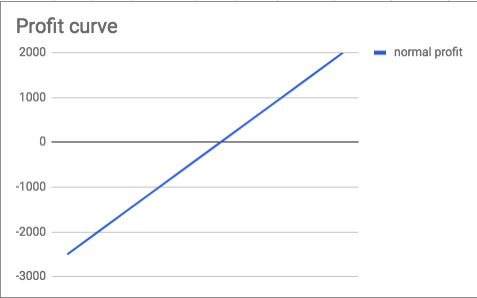

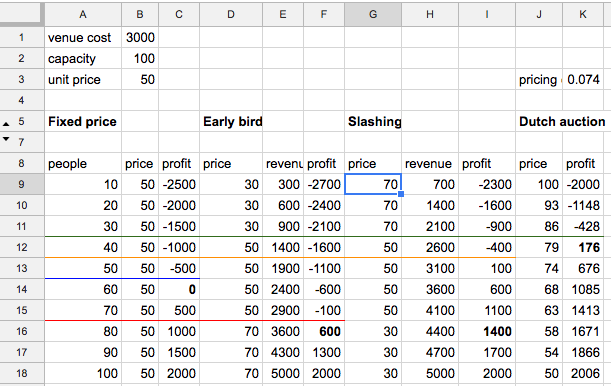

Fixed cost: $3000 Capacity : 100 people Average ticket price: $50

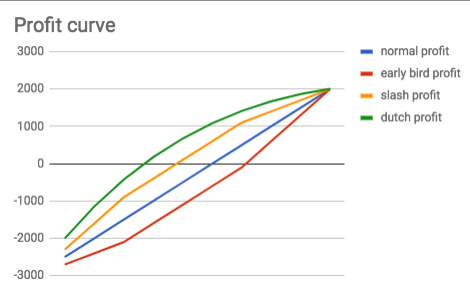

In the above condition, it will require minimum of 60 people to go break even with the maximum profit of $2000

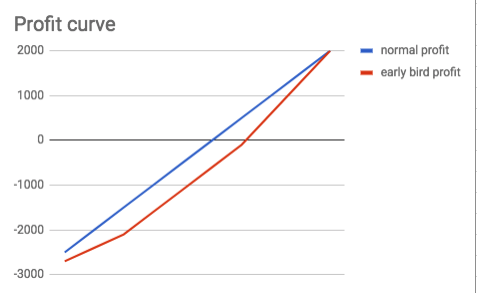

One of the most common way is to provide "early bird" discount tickets to try to fill the tickets as early as possible. Even though this may look correct at first, it will require more people to buy their tickets to break even. Also the final few tickets have to be higher to fill the gap of early bird ticketing.

If you provide first $30 discount ticket to the first 30 people, you need to sell to more than 70 people to go break even and also you have to increate the ticket of last 30 people to $70 to maintain the same profit level.

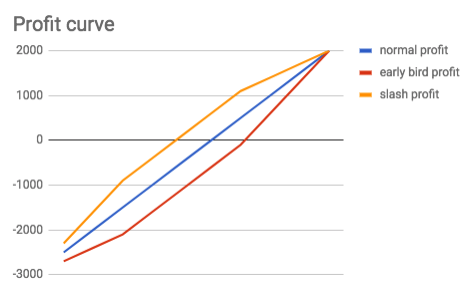

The alternative model to go break even faster is to simply increase the price from $50 to $70. The organiser does not need to cut down the price if the ticket is sold very quickly. However, it will be very hard to find out when they should start cuting down the price due to low demand and often it is too late. Also it is critical for event organisers to hide the fact that they may slash the cost as buyers expect to hold off their buying decision until the ticket price gets slashed.

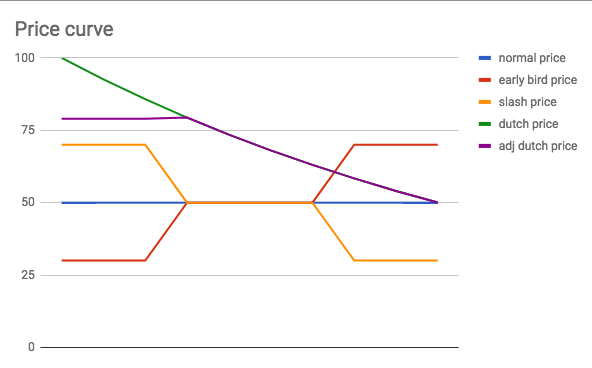

Our product uses "dutch auction" mmodel, a method of selling in which the price is reduced until a buyer is found. Unlike the price slashing model, all the buyers pay the same lowest price.

In the traditional auction model, the bidding price is often sealed so that each individuals can guess the lowest purchasable price.

In the blockchain crowdsale space, a couple of companies (Gnosis, Polkadot) have tried Dutch auction model where price is often determined based on the elapsed time as sealed bid is harder due to transparent nature of the blockchain.

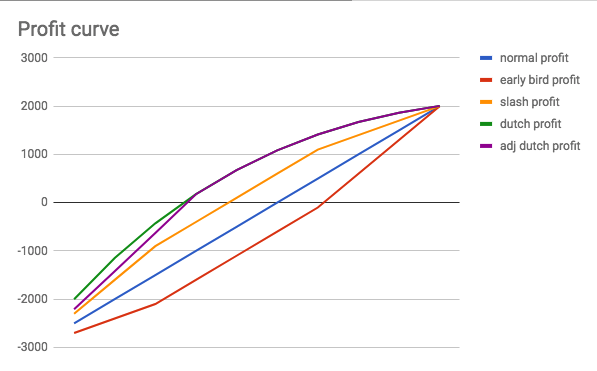

We propose the pricing model where price deceases based on the number of tickets sold (as opposed to time). This will incentivise buyers(= fans) to spread the words and encourage others to buy the tickets to lower down their own ticket price.

Unlike the early bird discount model, sellers reaches profitability earlier.

Unlike the price slashing model, users are more likely commit at higher price knowing that they are entitled to the same lower price as number of buyers increase.

If you are worried that initial higher price will scare off people, you can fix the price until you reach the break even points. (If possible) you can even say that you will cancel the event unless it reaches the break even points, closer to kick starter like product crowd funding model.

The below is the pricing curve.

I created a simple animation which can compare the different pricing curve based on different cost, price, and capacity.

The traditional pricing model (early bird/slashing) are based on information asynmetry where seller don't reveal the current demand/supply and using FOMO (Fear of missing out) tactic to the buyers. By making demand/supply data transparent using blockchain and make pricing dynamic using smart contract, both sellers and buyers are incentivised to sell more tickets together.