The initial monetary policy of CLO was temporarily and not suitable for long-term. The main goals of high emission monetary policy were:

-

avoid the effect of price collapse right after the airdrop (Watch EOS airdrops as an example of what could happen)

-

attract miners and initiate Cold Staking

-

reduce the influence of the airdropped coins owners to prevent their dominance in voting system

Now, as these goals can be considered achieved, it is necessary to move forwards and design a new monetary policy which will ensure long-term sustainability of CLO. I believe that monetary policy is life-important for the project and we must approach this issue with all the responsibility, understanding of fundamental principles and psychological aspects of crypto markets and stock trading.

Callisto Network is a project of Ethereum Commonwealth that’s been researched and designed, and has developed a reference implementation of a self-sustained, self-governed, self-funded blockchain ecosystem. It also improves the security of the ecosystem of crypto industry by improving smart-contract development methods and environment. (Quote: Callisto Network whitepaper)

Callisto aims to establish a secure and contribution-friendly environment for further protocol development and improvements. It will rely on a built-in system of smart-contracts to achieve this goal. (Quote: Callisto Network whitepaper )

Callisto Network whitepaper can be found here.

The core features of Callisto are:

-

Security Auditing departments (paid from Treasury)

-

Development team (paid from Treasury)

-

Treasury

Summarizing the above it can be concluded that one of the main goals of Callisto monetary policy is to ensure the viability of the system by maintaining the liquidity of Treasury funds, i.e. ensuring the ability of Treasury to be used for further development of the project.

It should be noted that Treasury is not a storage of value. The main goal of Treasury is to provide a source of funding for Callisto ecosystem, but not to accumulate wealth. Therefore, only Treasury income makes sense when designing a long-term monetary policy, but not the amount of funds which is already stored is Treasury.

The price and market capitalisation of an asset is determined by supply & demand. However, when talking about cryptocurrency markets, we should assume that demand is of decisive importance.

We can see plenty of high supply assets with high capitalisation (and high price) and a lot of low supply assets with low price. Some projects are just "big" and the other are just "another low profile coins" with low supply and low price. The destiny of a project is determined by how potential buyers evaluate it, thus the total success of a project is determined by market participants expectations.

In some cases, if you reduce the total supply then you will just reduce the market capitalization of an asset in long term. If there are no additional incentives to buy to ensure the demand (buy pressure) then the supply reduction will not directly affect the price. A good example is Ethereum Classic:

After the implementation of ECIP-1017 we can observe a short-term price surge (which was also caused by Callisto Airdrop which occurs on 5 March 2018) followed by long downtrend. The max total supply of ETC decreased from infinity to 233M, the inflation decreased as well. However, the price has not increased and currently remains lower than at the time of the implementation of the monetary policy.

Lesson is learned: Do not expect price surge when at wrong market phase and do not expect the increase of "demand" when you reduce the "supply".

Market cycles are known phenomenon in stock trading. Read this statements for better understanding.

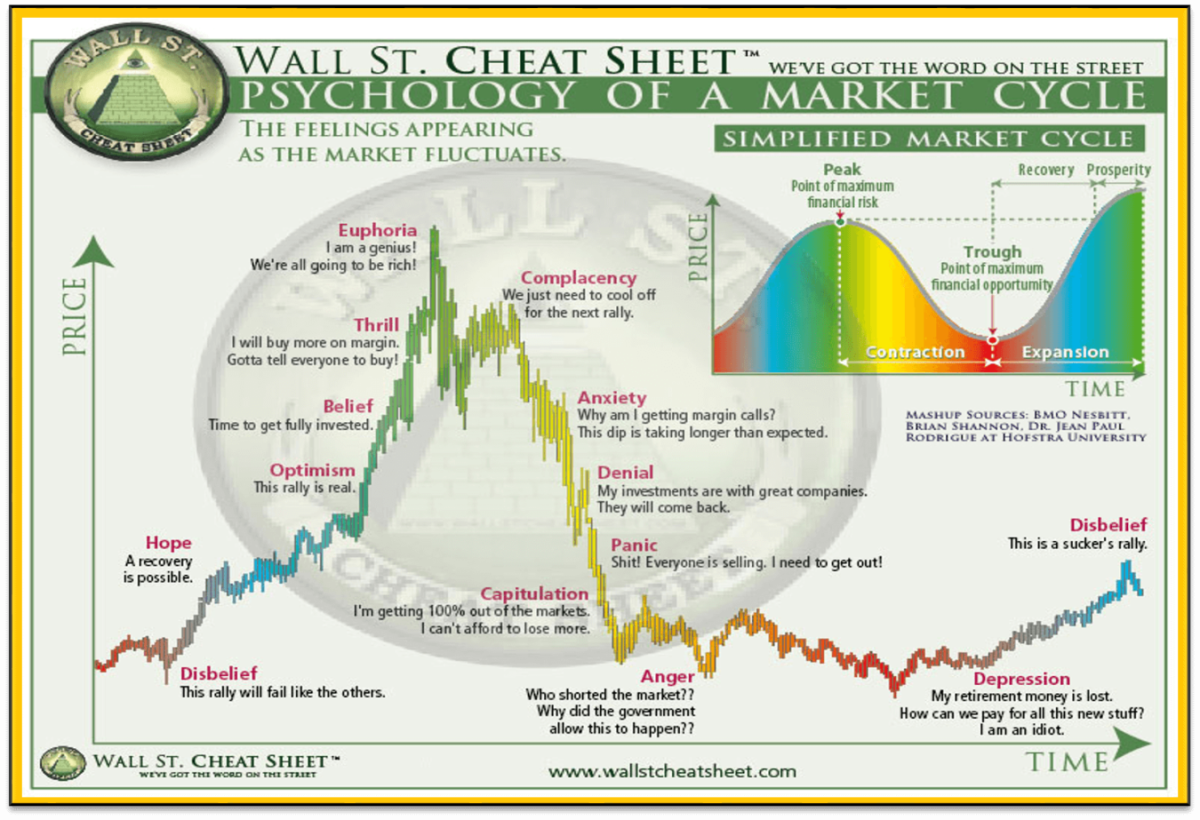

"Wall Street Cheat Sheet" illustration of what market cycles look like:

In crypto asset trading, market cycles are also important. All processes are cyclic and iterative. The hardest part of the cycle for investors and projects is the bearish phase ("Anger" and "Depression" on the image above). The effect of fundamental analysis is minimal, everything is stagnating no matter what. The outcome of positive news and successful development is zeroed out by lack of buyers.

According to the chart above, it can be concluded that the length of a single market cycle in crypto industry is about 260 days.

There are multiple kinds of participants in crypto market:

-

Newcomers

-

Professional traders (TA traders)

-

Investors/bagholders

Newcomers enter the crypto market during the mid-late bullish phase (Optimism, belief, thrill, euphoria on the image above). They invest in whatever they can without any research. Professional traders do not care about fundamental analysis because they trade charts. You can join a CryptoUB's discord group, Crypto cartel group or Luke Martin's group and scroll the history of messages to see how traders think.

Only a certain group of buyers evaluate fundamental analysis of an asset before buying it.

First of all, hashrate is a level of security. Higher hashrate guarantees the higher cost of 51%-attacks and better network stability.

It is also important that the hashrate is a measure of comparing one mineable project with another for investors and bagholders. When planning a long-term investment, it is the best option to invest into a "sleeping giant" - a project with low capitalisation with good fundamental analysis and huge upside potential.

"Price follows hashrate" is a known rule of crypto markets.

This rise in Bitcoin Cash SV’s hash rate attracts new purchases pushing Bitcoin SV prices.

Quote: Bitcoin Cash SV hashrate rises and so does the price of BSV article

Another historical proof of "price follows hashrate" theory is DOGE hashrate increase.

As it can be seen at the image above, at 2014/9/11 the hashrate of DOGE (102 Gh) has started to grow. At 2014/9/12 hashrate achieved a new high of 411 Gh.

At the same time the price remains unaffected and only reacted at 2014/9/13 (27% increase).

Another example of hashrate importance is project comparison:

BSV has $1,3B market cap and 711 Ph/s hashrate / BCH has $2,2B market cap and 1140 Ph/s hashrate. (2x market cap, 1,6x hashpower domination)

ETC has $0,46B market cap and 8,3 Th/s hashrate / ETH has $12,7B market cap and 168 Th/s hashrate. ( 27x market cap, 20x hashpower domination)

Hashrate comparison gives experienced investor a rough picture of expectations for a certain project compared to another project.

Because hashrate is the measure of expectations. You can check the whattomine page: https://whattomine.com/

Here you can see a diversity of hashpowers and projects, but not 100% of hashrate in the most profitable coin. In reality, what makes miners to keep mining unprofitable coins? The answer is simple - expectations. What makes miners to keep mining CLO when ETH is more profitable? The answer is still expectations.

The level of expectations is of decisive importance for traders because it determines the upside potential directly. If the level of expectations is high then bagholders will not massively sell in 2x profit, but keep holding longer, thus pushing the price higher and making coin to generate even more profit in long term.

Large projects do not discourage miners because the effect of losing hashrate could be disastrous. For example Ethereum has lowered the block reward by 33% only.

Lower block rewards reduce inflation but also discourage mining. | Quote: the above article

Earlier, Ethereum has also reduced block reward from 5 ETH to 3 ETH (by 40%), however this was done at the previous market cycle. It should be noted that Ethereum is one of the most successful projects in the whole crypto industry.

Bitcoin has 50% block reward reduction which is high enough, however this happens rarely - once per several market cycles (assuming local market cycle length is approximately equal to 260 days).

This statement is based on trading incentives. If the coin price increases, traders (and even bagholders) take profit, thus create selling pressure. This is a natural barrier of price increase. However, there is no such barrier for market capitalisation increase. In case of coin price staying the same coupled with increasing total supply - bagholders keep holding and traders have no incentives to sell without profit. This explains why market capitalisation increase is more realistic scenario.

There is no doubt that high inflation negatively affects the value of assets. At the other hand, the impact of inflation is overemphasize in case of crypto assets.

-

ZCash had 0,11%/day inflation rate at the launch stage and it did not prevent it from being among the top crypto projects of that time.

-

ERC20 tokens do not have emission, thus have zero inflation. However, this does not make most of them successful projects.

This may look simple as "reduce inflation == increase the price", but we should keep in mind the underlying processes which are not that obvious. There are two back sides of lowering inflation of Callisto: (1) the risk of losing hashrate, and (2) reducing Treasury income.

Speaking about the development of monetary policy, it is necessary to find a good balance between inflation and the preservation of the hash rate. Thinking simple and making hurried decisions without understanding the consequences is incredibly dangerous and may ruin the project in long term.

Taking the above statements into account, I can submit a set of rules which the desired monetary policy must match:

-

The main goal of the monetary policy is to ensure longterm sustainability of Callisto Network.

-

Inflation rate must be reduced.

-

Previously announced max cap must not be changed. The max cap of CLO is still 6,5 B coins.

-

It is necessary to reduce inflation no more than once per market cycle to ensure the ecosystem can rebalance.

-

A radical decrease in inflation is unacceptable since it would entail a decrease in hashrate.

-

Significant decrease in inflation during the bearish market cycle phase is even more harmful as it entails the reduction of Treasury income and endangers the viability of Callisto ecosystem and the existence of Callisto Team.

- Reduction stage: reduce block reward by 35% each 1,500,000 blocks (~250 days; we should keep in mind that block time is not constant as well) starting at 2,500,001 block, until reward per block will reach 45 CLO in 2022 year.

- Main stage: during the main phase, block reward will remain the same. The existence of main phase is required because the situation in crypto industry is changing quickly. Thus, it will change before the final stage and it may require Callisto Team to react taking into account the upcoming events.

- Final stage: reduce block reward by 2% each 500,000 blocks starting at 62,000,001 block (early 2043). This is necessary to preserve the announced max cap of Callisto.

| Start Block | End Block | Estimate End Date | Block Reward Reduction, % | Block Reward | Total CLO | Treasury income/month |

|---|---|---|---|---|---|---|

| 1 | 2 500 000 | 19.04.2019 | 0 | 600 | 1 600 000 000 | 10 500 000 |

| 2 500 001 | 4 000 000 | 22.11.2019 | 35 | 390 | 2 185 000 000 | 6 825 000 |

| 4 000 001 | 5 500 000 | 26.06.2020 | 35 | 254 | 2 565 250 000 | 4 445 000 |

| 5 500 001 | 7 000 000 | 29.01.2021 | 35 | 165 | 2 812 412 500 | 2 887 500 |

| 7 000 001 | 8 500 000 | 03.09.2021 | 35 | 107 | 2 973 068 125 | 1 872 500 |

| 8 500 001 | 10 000 000 | 08.04.2022 | 35 | 70 | 3 077 494 281 | 1 225 000 |

| 10 000 001 | 11 500 000 | 11.11.2022 | 35 | 45 | 3 145 371 283 | 787 500 |

| 11 500 001 | 62 000 000 | 12.11.2042 | 0 | 45 | ... | 787 500 |

| ... | ... | ... | ... | ... | ... | ... |

| 62 000 001 | 62 500 000 | 24.01.2043 | 2 | 44 | 5 452 736 823 | |

| 62 500 001 | 63 000 000 | 06.04.2043 | 2 | 43 | 5 474 466 513 | |

| ... | ... | ... | ... | ... | ... | ... |

| 173 000 001 | 173 500 000 | 12.01.2087 | 2 | 1 | 6 526 969 210 | |

| ... | ... | ... | ... | ... | ... | |

| 210 000 001 | 210 500 000 | 09.09.2101 | 2 | ~ 0 | 6 536 473 834 |