The initial monetary policy of CLO was temporarily and not suitable for long-term. The main goals of high emission monetary policy were:

-

avoid the effect of price collapse right after the airdrop (watch EOS airdrops as an example of what could happen)

-

attract miners and initiate Cold Staking

-

reduce the influence of the airdropped coins owners to prevent their dominance in voting system

Now, as these goals can be considered achieved, it is necessary to move forwards and design a new monetary policy which will ensure long-term sustainability of CLO. I believe that monetary policy is life-important for the project and we must approach this issue with all the responsibility, understanding of fundamental principles and psychological aspects of crypto markets and stock trading.

Callisto Network is a project of Ethereum Commonwealth that’s been researched and designed, and has developed a reference implementation of a self-sustained, self-governed, self-funded blockchain ecosystem. It also improves the security of the ecosystem of crypto industry by improving smart-contract development methods and environment. (Quote: Callisto Network whitepaper)

Callisto aims to establish a secure and contribution-friendly environment for further protocol development and improvements. It will rely on a built-in system of smart-contracts to achieve this goal. (Quote: Callisto Network whitepaper )

Callisto Network whitepaper can be found here.

The core features of Callisto are:

-

Security Auditing departments (paid from Treasury)

-

Development team (paid from Treasury)

-

Treasury

Summarizing the above it can be concluded that one of the main goals of Callisto monetary policy is to ensure the viability of the system by maintaining the liquidity of Treasury funds, i.e. ensuring the ability of Treasury to be used for further development of the project.

It should be noted that Treasury is not a storage of value. The main goal of Treasury is to provide a source of funding for Callisto ecosystem, but not to accumulate wealth. Therefore, only Treasury income makes sense when designing a long-term monetary policy, but not the amount of funds which is already stored is Treasury.

The price and market capitalisation of an asset is determined by supply & demand. However, when talking about cryptocurrency markets, we should assume that demand is of decisive importance.

We can see plenty of high supply assets with high capitalisation (and high price) and a lot of low supply assets with low price. Some projects are just "big" and the other are just "another low profile coins" with low supply and low price. The destiny of a project is determined by how potential buyers evaluate it, thus the total success of a project is determined by market participants expectations.

In some cases, if you reduce the total supply then you will just reduce the market capitalization of an asset in long term. If there are no additional incentives to buy to ensure the demand (buy pressure) then the supply reduction will not directly affect the price. A good example is Ethereum Classic:

After the implementation of ECIP-1017 we can observe a short-term price surge (which was also caused by Callisto Airdrop which occurs on 5 March 2018) followed by a long downtrend. The max total supply of ETC decreased from infinity to 233M, the inflation decreased as well. However, the price has not increased and currently remains lower than at the time of the implementation of the monetary policy.

Lesson is learned: Do not expect price surge when at wrong market phase and do not expect the increase of "demand" when you reduce the "supply".

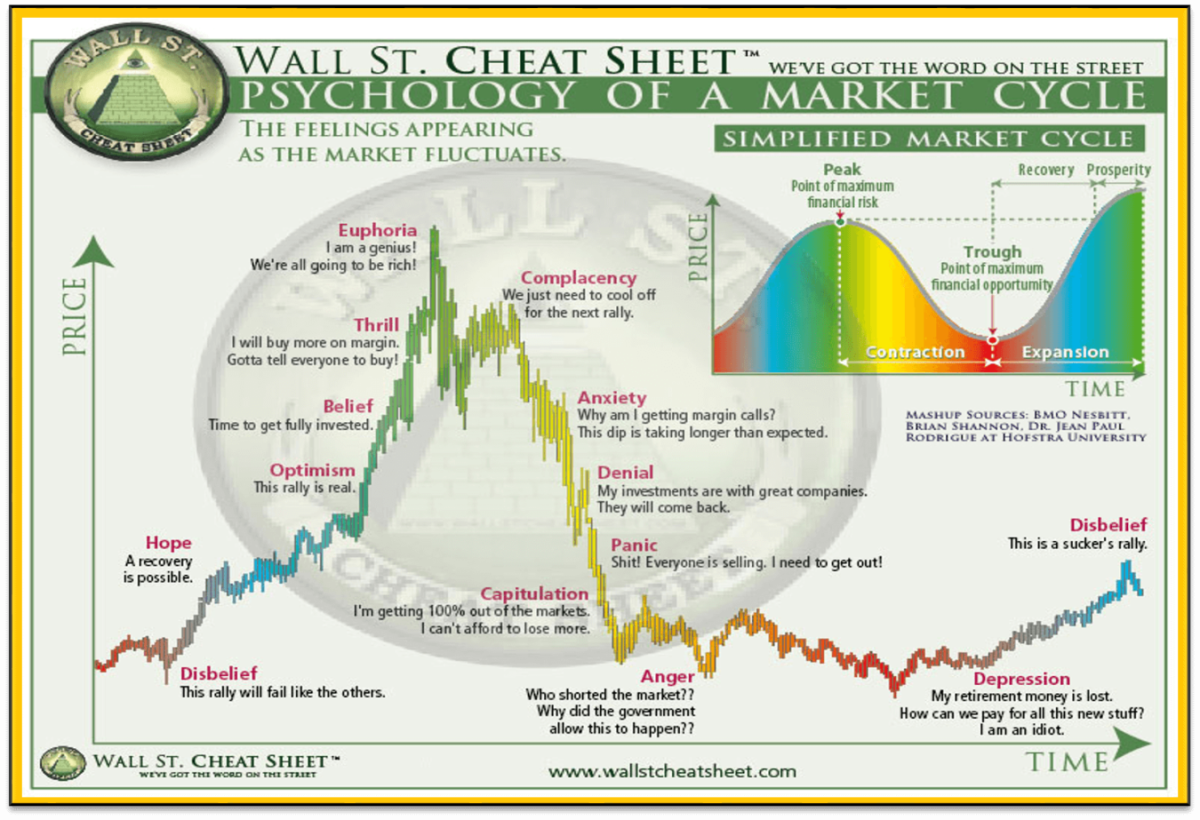

Market cycles are known phenomenon in stock trading. Read this statements for better understanding.

"Wall Street Cheat Sheet" illustration of what market cycles look like:

In crypto asset trading, market cycles are also important. All processes are cyclic and iterative. The hardest part of the cycle for investors and projects is the bearish phase ("Anger" and "Depression" on the image above). The effect of fundamental analysis is minimal, everything is stagnating no matter what. The outcome of positive news and successful development is zeroed out by lack of buyers.

According to the chart above, it can be concluded that the length of a single market cycle in crypto industry is about 260 days.

There are multiple kinds of participants in crypto market:

-

Newcomers

-

Professional traders (TA traders)

-

Investors/bagholders

Newcomers enter the crypto market during the mid-late bullish phase (Optimism, belief, thrill, euphoria on the image above). They invest in whatever they can without any research. Professional traders do not care about fundamental analysis because they trade charts. You can join a CryptoUB's discord group, Crypto cartel group or Luke Martin's group and scroll the history of messages to see how traders think.

Only a certain group of buyers evaluate fundamental analysis of an asset before buying it.

Callisto is based on the "gym theory of markets". According to this theory, it is important to keep holders incentivized to hold. Cold Staking is intended to incentivize buyers to hold, while high inflation is incompatible with this theory. It is important to keep inflation levels low enough to ensure holding incentivization.

A common argument against monetary inflation in cryptoasset networks like Bitcoin is the ‘sound money’ thesis. Sound money is generally defined as: money that has a purchasing power determined by markets, independent of governments and political parties — such as precious metals like Gold when used as a medium-of-exchange.

ZCash is also a good example of inflation impact.

ZCash is the first crypto asset which implements zk-snarks, however, it is now perceived only as an opportunity to make an anonymous transaction. In general, high inflation is a strong argument against long term holding, which is against the purpose of Cold Staking of Callisto.

Taking the above statements into account, we can submit a set of rules which the desired monetary policy must match:

-

The main goal of the monetary policy is to ensure longterm sustainability of Callisto Network.

-

Inflation rate must be reduced.

-

Previously announced max cap must not be changed. The max cap of CLO is still 6,5 B coins.

-

It is necessary to reduce inflation no more than once per market cycle to ensure that the ecosystem can rebalance.

-

A radical decrease in inflation is unacceptable since it would entail a decrease in hashrate.

-

Significant decrease in inflation during the bearish market cycle phase is even more harmful as it entails the reduction of Treasury income and endangers the viability of Callisto ecosystem and the existence of Callisto Team.

- Reduction stage (starts at block 2,750,001): reduce block reward by 40% each 1,500,000 blocks (~250 days) starting at 2,750,001 block and do it 4 times. Then reduce the block reward by 35% so that block reward becomes 50,54 CLO in 2022 year. Reduce mining reward percentage by 5% and increase Cold Staking reward percentage by 5% at each block reward reduction.

- Main stage (starts at block 10,250,001): during the main phase, block reward will remain the same. The existence of main phase is required because the situation in crypto industry is changing quickly. Thus, it will change before the final stage and it may require Callisto Team to react taking into account the upcoming events.

- Final stage (starts at block 55,250,001): reduce block reward by 2% each 500,000 blocks starting at 55,250,000 block (2040 year). This is necessary to preserve the announced max cap of Callisto.

A full table with detailed numbers can be found here: https://docs.google.com/spreadsheets/d/1WtxDprdbxO0Xmm4dBWeazvnT6fp_xYXw6fe3hCDBpCk/edit#gid=1751251200

| Start Block | End Block | Estimate End Date | Block Reward Reduction, % | Block Reward | Total CLO | Treasury income/month | Mining, % | Cold Staking, % |

|---|---|---|---|---|---|---|---|---|

| 1 | 2 750 000 | 25.05.2019 | 0 | 600 | 1 750 000 000 | 10 500 000 | 70 | 20 |

| 2 750 001 | 4 250 000 | 28.12.2019 | 40 | 360 | 2 290 000 000 | 7 464 960 | 65 | 25 |

| 4 250 001 | 5 750 000 | 01.08.2020 | 40 | 216 | 2 614 000 000 | 4 478 976 | 60 | 30 |

| 5 750 001 | 7 250 000 | 06.03.2021 | 40 | 129,6 | 2 808 400 000 | 2 687 386 | 55 | 35 |

| 7 250 001 | 8 750 000 | 09.10.2021 | 40 | 77,76 | 2 925 040 000 | 1 612 431 | 50 | 40 |

| 8 750 001 | 10 250 000 | 03.03.2022 | 35 | 50,54 | 3 000 856 000 | 1 048 080 | 45 | 45 |

| 10 250 001 | 55 250 000 | 11.03.2040 | 0 | 50,54 | ... | 1 048 080 | 45 | 45 |

| ... | ... | ... | ... | ... | ... | ... | 45 | 45 |

| 55 250 001 | 55 750 000 | 22.05.2040 | 2 | 49,52 | 5 300 102 560 | 45 | 45 | |

| 55 750 001 | 56 250 000 | 2.08.2040 | 2 | 48,54 | 5 324 373 789 | 45 | 45 | |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 173 250 001 | 173 750 000 | 17.02.2087 | 2 | 1 | 6 503 350 273 | 45 | 45 | |

| ... | ... | ... | ... | ... | ... | ... | ... | |

| 210 250 001 | 210 750 000 | 15.10.2101 | 2 | 0,09 | 6 511 351 162 | 45 | 45 |