In 1998, Edgar L. Feige developed the concept of the Automated Payment Transaction (APT) Tax, taxing the broadest possible tax base at the lowest possible tax rate. Johan Nygren then developed the idea of transaction-pathways, in 2012, a swarm organization infrastructure for wealth redistribution. The transaction-pathways made it possible to replace deterrents as an incentive, with a reward system, in the form of universal basic income (UBI).

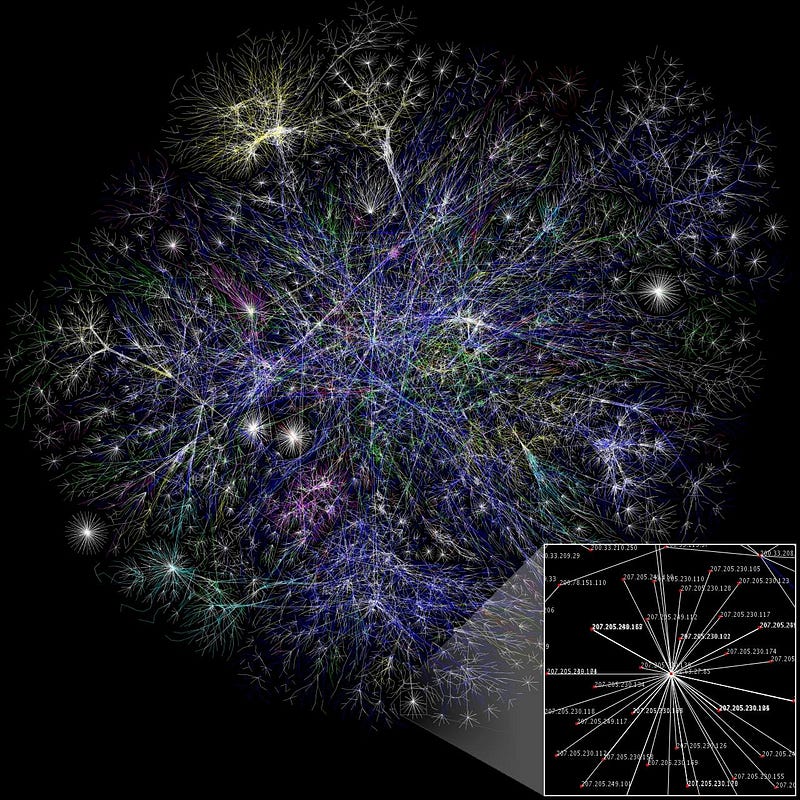

If the “engine” of a coercive taxation system is deterrents, under a monopoly on violence, then in “incentivized taxation” there is instead a reward, where people have an incentive to consume with the currency, because that makes them receive universal basic income (UBI) from the tax pool, via transaction-pathways within the transaction-web.

/* Create an object for dividend pathways */

struct dividendPathway {

address from;

uint amount;

uint timeStamp;

}

/* This creates an array with all dividend pathways */

mapping(address => dividendPathway[]) public dividendPathways;

Within nation-state taxation or centralized taxation, taxes flow to the center, and then outwards, whereas in network-state taxation, or “incentivized taxation”, taxes flow through the transaction-web, directly to people (who in turn can perform a role in further re-allocation of wealth, using Taxemes, or a centrally regulated tax-budget. )

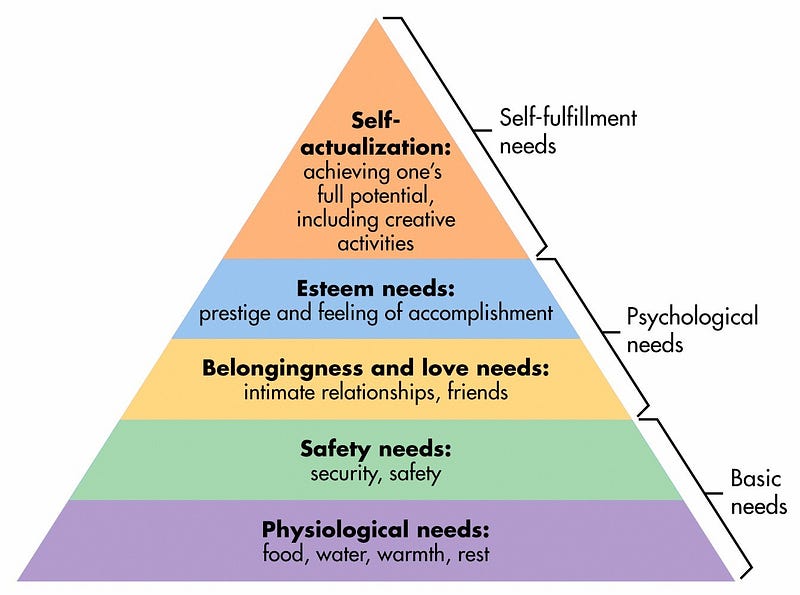

Deterrents act on survival instincts, and in “incentivized taxation”, universal basic income as a reward also acts on physiological needs and safety needs, but rather than pushing the individual in a specific direction, it pulls the individual. The result is similar, but the cost in human utility is much lower (deterrents is very high cost. )

Taxation for the 21ST Century: The Automated Payment Transaction (APT) Tax — Edgar L. Feige