- Ensure your nodes (and wallets) are fully synchronized with the blockchain network before placing orders. The software will verify this for you in the next patch release.

- Never shutdown your wallets with dexc running. When shutting down, always stop dexc before stopping your wallets.

- If you have to restart dexc with active orders or swaps, you must immediately login again with your app password when dexc starts up. The next patch release wil inform you on startup if this is required.

- There is a 5 minute "inaction timeout" when it becomes your client's turn to broadcast a transaction, so be sure not to stop dexc or lose connectivity for longer than that or you risk having your active orders and swaps/matches revoked. If you do have to restart dexc, remember to login as soon as you start it up again.

- Only one dexc process should be running for a given user account at any time. For example, if you have identical dexc configurations on two computers and you run and login on both, neither dexc instance will be adequately connected to successfully negotiate swaps. Also note that order history is not synchronized between different installations at this time.

- Your DEX server accounts exist inside the dexc.db file, the location of which depends on operating system, but is typically in ~/.dexc/mainnet/dexc.db or %HOMEPATH%\Local\Dexc\mainnet\dexc.db. Do not delete this account or you will need to register again at whatever server was configured in it.

This release of DCRDEX includes a client program called dexc and a server called dcrdex. Users run their own wallets (e.g. dcrwallet or bitcoind), which dexc works with to perform trades via atomic swaps. dcrdex facilitates price discovery by maintaining an order book for one or more markets, and coordinates atomic swaps directly between pairs of traders that are matched according to their orders. The server is generally run on a remote system, but anyone may operate a dcrdex server.

This release supports Decred, Bitcoin, and Litecoin.

- Provides a browser-based interface, which is self-hosted by the dexc program, for configuring wallets, displaying market data such as order books, and placing and monitoring orders.

- Communicates with any user-specified dcrdex server.

- Funds orders and executes atomic swaps by controlling the external wallets (dcrwallet, etc.).

- Accepts orders from clients who prove ownership of on-chain coins to fund the order.

- Books and matches orders with an epoch-based matching algorithm.

- Relays swap data between matched parties, allowing the clients to perform the transactions themselves directly on the assets' blockchains.

- Has a one-time nominal (e.g. 1 DCR) registration fee, which acts as an anti-spam measure and to incentivize completing swaps.

- Enforces the code of community conduct by suspending accounts that repeatedly violate the rules.

The server maintains a familiar market of buy and sell orders, each with a quantity and a rate. A market is defined by a pair of assets, where one asset is referred to as the base asset. For example, in the "DCR-BTC" market, DCR is the base asset and BTC is known as the quote asset. A market is also specified by a lot size, which is a quantity of the base asset. Order quantity must be a multiple of lot size, with the exception of market buy orders that are necessarily specified in units of the quote asset that is offered in the trade. The intent of a client to execute an atomic swap of one asset for another is communicated by submitting orders to a specific market on a dcrdex server.

The two types of trade orders are market orders, which have a quantity but no rate, and limit orders, which also specify a rate. Limit orders also have a time-in-force that specifies if the order should be allowed to become booked or if it should only be allowed to match with other orders when it is initially processed. The time-in-force options are referred to as "standing" or "immediate", where standing indicates the order is allowed to become booked while immediate restricts that order to being a taker order by only allowing a match when it is initially processed.

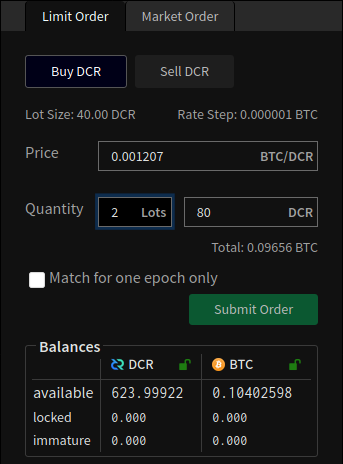

The following image is an example order submission dialog from a testnet DCR-BTC market with a 40 DCR lot size that demonstrates limit order buying 2 lots (80 DCR) at a rate of 0.001207 BTC/DCR using a standing time-in-force to allow the order to become booked if it is not filled:

Checking the "Match for one epoch only" box above specifies that the limit order's time-in-force should be immediate, while unchecking it allows the order to be booked if it does not match with another order at first. The concept of epochs is described in the Epoch section.

Since orders must be funded by coins from the user's wallets, placing an order "locks" an amount in the relevant wallet. For example, a buy order on the DCR-BTC market marks a certain quantity of BTC as locked with the user's wallet. (This involves no transactions or movement of funds.) This amount will be shown in the "locked" row of the Balances table.

It is important to note that the amount that is locked by the order may be larger than the order quantity since the "locked" amount is dependent on the size of the UTXO (for UTXO-based assets like Bitcoin and Decred) that is reserved for use as an input to the swap transaction, where the amount that does not enter the contract goes in a change address. This is no different from when you make a regular transaction, however because the input UTXOs are locked in advance of broadcasting the actual transaction that spends them, you will see the amount locked in the wallet until the swap actually takes place.

Depending on the asset, there may be a wallet setting on the Wallets page to pre-size funding UTXOs to avoid this over-locking, but (1) it involves an extra transaction that pays to yourself before placing the order, which has on-chain transaction fees that may be undesirable on chains like BTC, and (2) it is only applied for limit orders with standing time-in-force since the the UTXOs are only locked locked until the swap transaction is broadcasted, which is relatively brief for taker-only orders that are never booked.

Select commits:

An important concept with DCRDEX is that newly submitted orders are processed in short windows of time called epochs, the length of which is part of the server's market configuration, but is typically on the order of 10 seconds. When a valid order is received by the server, it enters into the pool of epoch orders before it is matched and/or booked. The motivation for this approach is described in detail in the DCRDEX specification. The Your Orders table will show the status of such orders as "epoch" until they are matched at the end of the epoch, as described in the next section.

Order cancellation requests are also processed in the epoch with trade (market/limit) orders since a cancellation is actually a type of order. However, from the user's perspective, cancelling an order is simply a matter clicking the cancel icon for one of their booked orders.

Select commits:

- market: epoch queue processing

- multi: add client epoch queue

- core: handle epoch order messages

- app/charts: show epoch limit orders on depth chart

When the end of an epoch is reached, the orders it includes are then matched with the orders that are already on the book. A key concept of DCRDEX order matching is a deterministic algorithm for shuffling the epoch orders so that it is difficult for a user to game the system. To perform the shuffling of the closed epoch prior to matching, clients with orders in the epoch must provide to the server a special value for each of their orders called a preimage, which must correspond to another value that was provided when the order was initially submitted called the commitment. This is done automatically by dexc, requiring no action from the user.

If an order fails to match with another order, it will become either booked or executed with no part of the order filled. The Your Orders table displays the current status and remaining quantity of each of a user's orders. If an order does match with another trade order, the order status will become settling, and atomic swap negotiation begins.

Select commits:

- order commitment field and preimage-based epoch queue shuffle

- spec: add order commitments

- create server/matcher/mt19937 package

- spec: order shuffling with mt19937, preimages, checksum

When maker orders (on the book) are matched with taker orders from an epoch, the atomic swap sequence begins. No action is required from either user during the process.

In the current atomic swap protocol, the maker initiates by broadcasting a transaction with a swap contract on the relevant asset network, and informing the server of the transaction and the full contract. The server audits the contract, and if it is successfully validated, the information is relayed to the taker, who independently audits the contract to ensure it meets their expectations. The transaction containing the maker's swap contract must then be mined and reach the swap confirmation requirement, which is also a market setting. For example, Bitcoin might require 3 confirmations while other chains like Litecoin might be considerably more. When the required number of confirmations is reached, the taker participates by broadcasting a transaction with their swap contract and informing the server. Again, the server and the counterparty audit the contract and wait for that asset's swap confirmation requirement. When the required confirmations are reached, the maker redeems the taker's contract and informs the server of the redemption transaction. This is the end of the process for the maker, as the redemption spends the taker's contract, paying to an address controlled by the maker. The server relays the maker's redeem data to the taker, and the taker redeems immediately, ending the swap.

The Order Details page shows each match associated with an order. For example, a match where the user was the taker is shown below with links to block explorers for each of the transactions described above. The maker will have their redemption listed, but not the taker's.

Orders may be partially filled in increments of the lot size. Hence a single order may have more than one match (and thus swap) associated with it, each of which will be shown on the Order Details page.

Wallet balances will change during swap negotiation. When the client broadcasts their swap contract, the amount locked in that contract will go into the "locked" row for the asset that funded the order. When the counterparty redeems their contract, that amount will be reduced by the contract amount, and the user will redeem the counterparty contract, thus adding to the balance of the other asset. This is the essence of the atomic swap. Note that until the redemption transactions are confirmed, the redeemed amount may remain in the wallet's "immature" balance category, but this depends on the asset.

While the atomic swap process requires no party to trust the other, a swap may be forced into an alternate path ending in one or both users refunding themselves by spending their own contract after the lock time expires. This happens when one of the parties fails to act in the expected time frame, an inaction timeout. When an inaction timeout occurs the following happens:

- The match is revoked, and both parties are notified.

- The at-fault user has their order revoked (if it was partially filled and still booked) and is notified.

- The at-fault user has their score adjusted according to type of match failure. See below for descriptions of each type and the associated user score adjustments.

The general categories of match failures are:

NoMakerSwap: A match is made, but the maker does not initiate the swap. No transactions are created in this case.NoTakerSwap: The maker (initiator) broadcasts their swap contract transaction and informs the server, but the taker (participant) fails to broadcast their swap contract and inform the server. The maker will automatically refund their contract when it expires after 20 hrs.NoMakerRedeem: The taker broadcasts their swap and informs the server, but the maker does not redeem it. The taker will refund when their contract expires after 8 hrs. Note that the taker's client begins watching for an unannounced redeem of their contract by the maker, which reveals the secret and permits the taker to redeem as well, completing the swap although in a potentially extended time frame.NoTakerRedeem: The maker redeems the taker's contract and informs the server, but the taker fails to redeem the maker's contract even though they can do so at any time. This case is not disruptive to the counterparty, and is only detrimental to the takers, so it is of minimal concern.

NOTE: The order remaining amounts are still reduced at match time although they did not settle that portion of the order.

Users have an incentive to respond with their preimage for their submitted orders and to complete swaps as the match negotiation protocol specifies, and if they repeatedly fail to act as required, their account may be suspended. This may require either communicating an excusable reason for the issue to the server operator, or registering a new account. However, a reasonable scoring system is established to balance the need to deter intentional disruptions with the reality of unreliable consumer networks and other such technical issues.

In this release, there are two primary inaction violations that adjust a users score: (1) failure to respond with a preimage for an order when the epoch for that order is closed (preimage miss), and (2) swap negotiation resulting in match revocation as described in the previous section.

The score threshold at which an account becomes suspended (ban score) is an operator set variable, but the default is 20.

The adjustment to the at-fault user's score depends on the match failure:

| Match Outcome | Points | Notes |

|---|---|---|

NoMakerSwap |

4 | book spoof, taker needs new order, no locked funds |

NoTakerSwap |

11 | maker has contract stuck for 20 hrs |

NoMakerRedeem |

7 | taker has contract stuck for 8 hrs |

NoTakerRedeem |

1 | counterparty not inconvenienced, only self |

Success |

-1 | offsets violations |

A preimage miss adds 2 points to the users score.

The above scoring system should be considered tentative while it is evaluated in the wild.

This release uses an experimental system to set the maximum order quantity based on their swap history. It is likely to change, but it is described in PR #750.

This release consists of 473 pull requests comprising 506 commits from 12 contributors.

Contributors (alphabetical order):

- Brian Stafford (@buck54321)

- David Hill (@dajohi)

- @degeri

- Donald Adu-Poku (@dnldd)

- Fernando Abolafio (@fernandoabolafio)

- Joe Gruffins (@JoeGruffins)

- Jonathan Chappelow (@chappjc)

- Kevin Wilde (@kevinstl)

- @song50119

- Victor Oliveira (@vctt94)

- Wisdom Arerosuoghene (@itswisdomagain)

- @zeoio

(there is no previous release to which a diff can be made)