I am not a lawyer! I am not a certified accountant, economist, investment authority, or "financial advisor" in any formal capacity! This information is provided purely based on personal anecdotes and recollections, and I cannot guarantee the accuracy or validity of any of it. How you choose to handle your money and investments is entirely your own choice and your own risk. Caveat emptor!

Now with that out of the way...

This is what you get if you earn a wage but choose not to contribute to and manage any retirement accounts. Basically, you can expect to get Social Security if you work a job and do nothing else.

- Generally, it's 6% of your gross wages, with an equal match from your employer.

- (You automatically pay into this from payroll as a US employee.)

- There are additional rules for high-income earners, self-employed, contractors, etc.

- It's complicated!

- Effectively, it's a sliding scale based on your income, how long you work, and at what age you retire. Also, benefits automatically increase each year based on increases in the Consumer Price Index.

- Search for a "Social Security benefits calculator" for details.

- e.g. Social Security Quick Calculator (ssa.gov)

- To give you a basic idea, when I expect to retire, calculators suggest I will get ~$2000/month in today's uninflated dollars or ~$7000/month in projected future-inflated dollars. That's not much compared to my current salary.

- Lots of people have concerns that the Social Security system is fundamentally broken without major changes.

- Payouts are expected to outpace income/contributions as the "baby boomer" generation and younger enter retirement.

- Expected to only have enough assets to pay $0.73 per $1.00 of projected payout in 2078 if no changes are made.

- (However, letting Social Security collapse would be political suicide because Social Security supports the largest voting block in the US: old people!)

- Should you have other retirement plans? How much should you rely on Social Security to keep you afloat?

401(k) and IRAs that we'll discuss are investment accounts, not savings accounts. (We'll cover the differences between 401(k) and IRAs later...)

Savings accounts are managed by banks, take cash deposits, and earn simple interest at publicly advertised rates. They should always grow, never shrink. Deposits are FDIC insured up to $250,000.

Investment accounts are managed by brokers who purchase stocks and bonds with your contributions. The success or failure of investment accounts is not guaranteed but is determined by your investment choices and strategies.

When you open an investment account, your broker presents you with a catalog of investments to purchase. These may include domestic stocks, international stocks, short-term bonds, and long-term bonds. You specify how you want your contributions to be spent, and you can monitor and manage those assets over time.

Research. :) It all depends on how much risk you are willing to take and how directly you want to be involved in the investing process.

The most common low-touch answers include using broker-managed portfolios:

- Target-Date Funds

- These are selected by indicating what year you plan to retire, and your broker adjusts investment allocations automatically over the years leading to your retirement year. These portfolios start with more aggressive stock-heavy options when you are young and gradually transition to more stable bond-heavy options when you are old.

- Index Funds

- These try to maintain a portfolio that matches one of the big public stock indices like the S&P500. The contents of these portfolios change regularly to keep pace with the stock market. These are often used because indices have a long history of positive year-over-year returns.

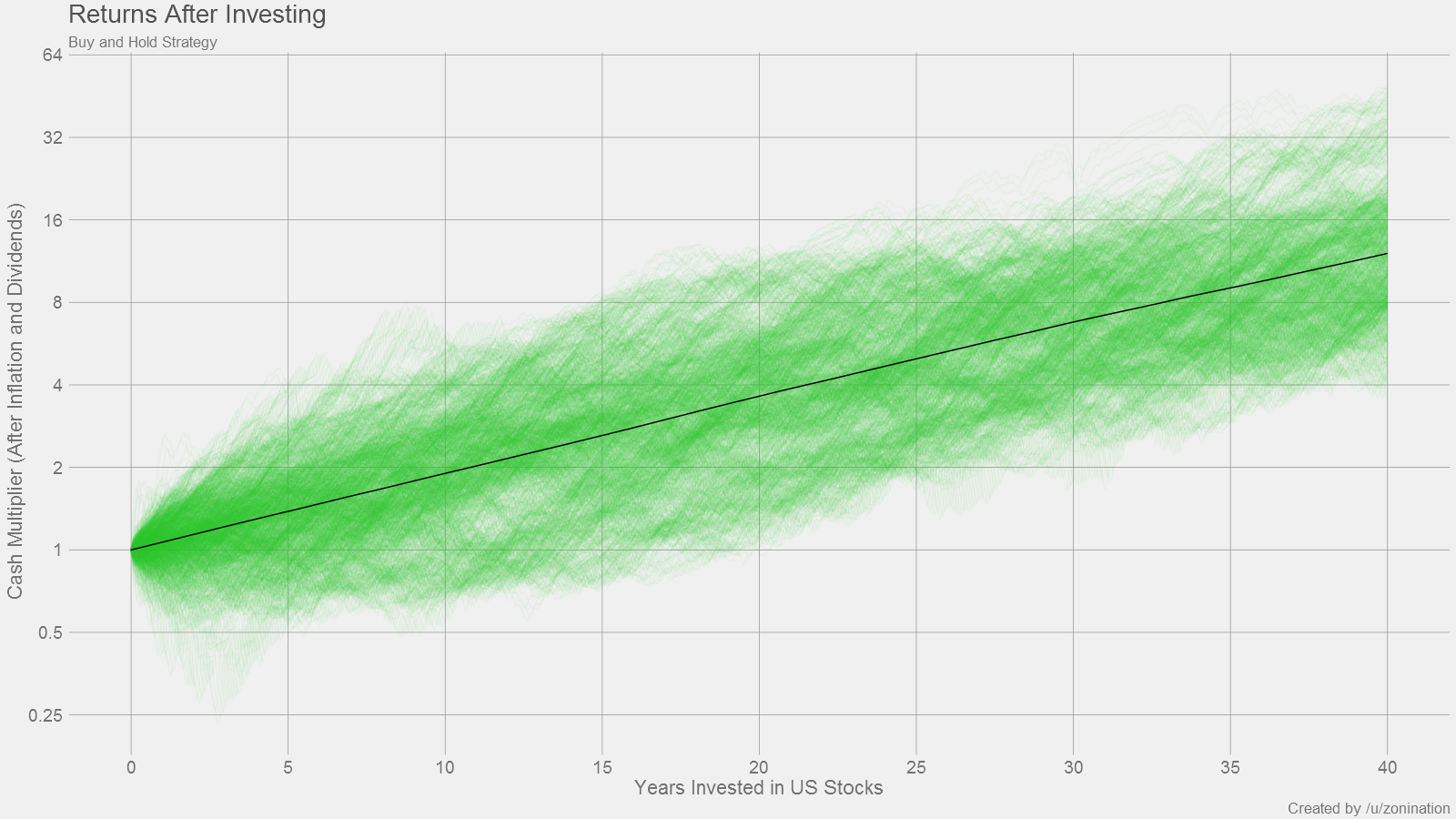

As a whole, the US stock market tends to grow 7% every year.

(source)

(source)

- Retirement Account: For the sake of this discussion, this is a special type of investment account that you own and that is intended to grow without you making any withdrawals until you reach retirement age (usually 59.5+ years old).

- Contributions: Money you (or your employer) put into the account, like a deposit.

- Distributions: Money paid to you from the account, like a withdrawal.

- Earnings: The growth of the assets value in your account.

- Tax-deferred: If an account is tax-deferred, that means you do not incur income taxes on the money you earned when you contribute to it, but instead you pay income taxes when you take distributions later.

- Tax-free earnings: If an account has tax-free earnings, that means you will not pay income tax when you take distributions from the earnings.

You've likely heard of this one. It's probably the easiest and most common retirement investment option today.

- Tax-deferred retirement account.

- "401(k)" is actually a subsection number of the Internal Revenue Code under US federal tax law.

- Your Traditional 401(k) accounts belong to you. You keep your employer-sponsored account when you leave one job to retire or get a new job. You may choose to transfer/rollover from old to new accounts, or you can keep the old accounts active. Your choice.

- Compare this to Social Security where there is basically one big shared government-managed account.

- Contributions are taken from your paycheck before your income tax is calculated.

- Is this a good thing for you?

- Maybe! Your contribution amount reduces your effective income when you contribute. So, you pay less income tax that year. This also reduces the withholdings in your paycheck.

- Is this a good thing for you?

- Distributions (i.e. withdrawals) are subject to standard income tax rates at the time you take them.

- All of your distributions (original contribution plus earnings) are subject to income tax when you take them.

- If you withdraw before age 59.5, you pay an additional 10% penalty.

- There are some special exceptions for early distributions for buying your first home, education expenses, and medical expenses.

- Because of this tax-deferred feature, Traditional 401(k) is especially advantageous if you expect to be in a lower income tax bracket when you retire.

- Many employers that offer 401(k) include a matching program.

- Matching means the employer will contribute extra money to your 401(k) for free.

- What's the catch? They only contribute to match if you contribute.

- Citrix's matching is "50% of up to 6%". This means if you contribute 6% of your wages to your 401(k), Citrix will throw in an extra 50% of that 6% (so, 3% of your wages) for free.

- This is free money. You should almost always contribute enough to get the maximum match.

- As of 2016, you can contribute up to $18,000 each tax year.

- This excludes the employer match; the combined limit for employee and employer is $53,000.

The Traditional IRA behaves similarly to the Traditional 401(k) in that they are both tax-deferred investment accounts. So, contributions (may) reduce your effective income, and distributions are subject to income tax. They differ in how you contribute, employer matching, special cases for early withdrawals, and level of protection in case of bankruptcy.

IRA stands for Individual Retirement Account. Traditional because it predates the Roth IRA.

The basic function is like the Traditional 401(k), except:

- Funds do not automatically come pre-tax from your paycheck.

- You have to make contributions into the account yourself.

- Contributions are (usually) tax deductible.

- This means your income is still subject to withholding when you get your paycheck, and you have to deal with calculating and optimizing your deductions for a refund when you file your taxes at the end of the year.

- Employer matching is not available. Only you make contributions.

- As of 2016, you can contribute up to $5,500 each tax year.

- (Only if you earn <$117,000 as an individual or <$184,000 when filing jointly.)

Given the choice, you probably should use a Traditional 401(k).

However:

- Some employers don't offer 401(k) programs but you still want to invest.

- You may have better investment options or lower fees if you work with your own broker instead of a company's 401(k) broker.

(Or you can invest in both if you are interested!)

It's like the Traditional IRA, but in name only! Otherwise, it's a whole new game.

The Roth IRA is a newer type of IRA that was established in 1989, named after the US senator who proposed the idea. It has very different income tax implications when compared to the Traditional 401(k) and Traditional IRA, but its tax-free earnings feature is very attractive for some investors.

- Contributions are not tax-deferred. You pay normal income tax on them in the year they were made.

- However, distributions to you are made income tax-free. This means you have tax-free earnings, and you would pay no income tax on the increased value of the assets as the account grew over time.

- Because of this tax-free earnings feature, Roth IRA is especially advantageous if you expect to be in a higher income tax bracket when you retire.

- As of 2016, you can contribute up to $5,500 each tax year.

- (Only if you earn <$117,000 as an individual or <$184,000 when filing joinly.)

- Important Note: You can have both a Traditional IRA and a Roth IRA account, but the combined contribution limit to them is the same $5,500 each tax year.

This is the newest type of retirement account that tries to mix some of the benefits of the Traditional 401(k) with the Roth IRA.

- Contributions are not tax-deferred. This behaves like the Roth IRA.

- Distributions are made income tax-free with tax-free earnings. This also behaves like the Roth IRA.

- Employers can contribute matching funds. This behaves like the Traditional 401(k).

- Contribution limit is $18,000 combined with the Traditional 401(k).

Here is an easy-to-follow flow chart for the novices:

Aim to fill the boxes from the top down as long as you have sufficient funds:

- build and maintain a 3-6 month emergency fund

- contribute enough to your 401(k) to get the full company match

- pay down any high-interest debts

- credit cards, auto loans

- not necessarily a mortgage unless you have a really bad interest rate

- max out your IRA to $5.5K/year

- max out your 401(k) to $18K/year

- start another private savings or investments account

- (not qualifying for the tax benefits of 401(k)s and IRAs)

See also: Comparison of 401(k) and IRA accounts (Wikipedia)