Dear Juno community. We are the fund like team which has many clients with high expectations for the Cosmos ecosystem in general.

We consider Prop16 is one of the most important discussions which is going to remain in the blockchains history.

Therefore, we hope that we have to talk about the problem with full consideration without letting it too simplistic.

- We didn’t game to get $JUNO airdrop with insider information

- Our $JUNO is not held by individual but held many clients

- The problem has been resolved by Prop4 from the double jeopardy perspective as well

- The essence of Prop 16 is “whether assets should be confiscated because the Juno whale holding more than the liquidity may pose a threat to the community in the future”

- False propaganda by Wolfcontract, one of the Juno core team

- Juno core team made the falsification of some documents regarding the airdrop to justify their claims

- We are not an entity to destroy Juno but a part of the Juno community members looking forward to its prosperity

- Measures against the risks asserted in Prop16

- Juno core team members are selling Juno regularly

- Is it possible to deprive someone of his or her individual asset if it benefits the general public? It never should be.

- Juno community members have an incentive to vote “yes” to the proposal

- 2.5M $JUNO allocated for official delegation program and $JUNO managed by the core team should be used to vote at least Abstain Conclusion

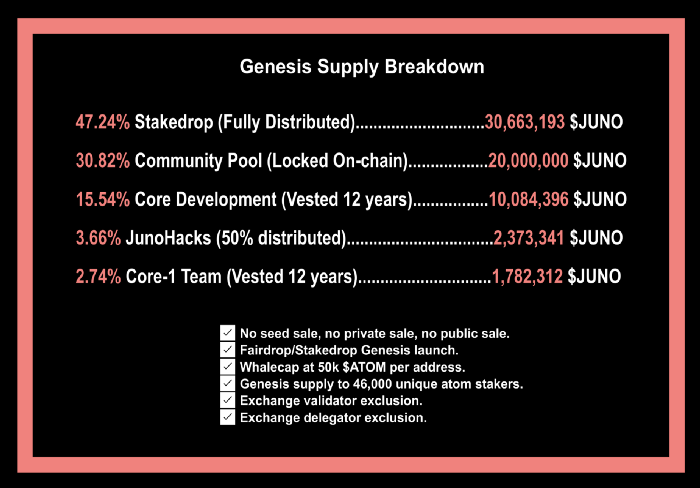

First of all, we would like to formally announce that we didn’t do any illegal acts to get $JUNO airdrop with insider information. The community has discussed how we acquire airdrops in unfair ways, but it is not true.

Before Juno’s idea came out, we held $ATOM as client assets, most of which was managed by each address with 100k $ATOM from a security perspective.(If we had gotten insider information, we should have managed $ATOM with 50k for each address.)

It is clear that we didn’t game the airdrop from what Wolfcontract tweeted as of Prop4.

https://twitter.com/wolfcontract/status/1447932849101869056

It’s not our fault to get the airdrop and it’s unreasonable that they criticize us with a pack of lies saying as if we gamed it without pursuing the responsibility as a fault of the airdrop design by the core team.

And criticism like this is not correct.

https://twitter.com/TheJunonaut/status/1501957393977995267

We’ve never carried out unethical gaming.

We hope they stop spreading incorrect things.

This person has analyzed and made a very useful document that proves we didn’t do anything fraudulent.

https://jabbey-io.medium.com/game-ing-stakedrops-d02a826ff791

How on earth can we go back to February to get the airdrop information in order to game it? We can never do this.

If this proposal is passed, it is fair to do the same for large holders other than us. Our quick research shows that as of 3/12/2022, the address holds more than 50k $JUNO. Some of these addresses are holding more than 50k juno and selling a portion of their staking rewards by separating $ATOM to several addresses as we do.

Strict adherence to the proposal makes it appropriate to return the assets of such addresses to the community pool as well, and the line must be clearly delineated. It would be too violent to confiscate only our assets, despite the fact that this has not been discussed.

Our $JUNO is not a personal asset. It is owned by many clients. Most of the clients also have huge expectations for Juno. They also buy $JUNO personally apart from us. And we also feel resentment and insecurity toward such Prop.

Based on the above facts, we would like to declare our opinions firmly.

Firstly, as you all members know, the problem that happened this time was once discussed in Prop 4.

The details of Prop 4 were the confiscation of 90% of airdrops because of the possibility of illegality.

At the time, we voted “Abstain” to leave it to the community’s judgment.

As a result, Prop 4 was rejected. Most of the opinions in the community at that time were that ‘The whale did not illegally get airdrops, so there are no responsibilities’ or ‘The assets owned by individuals shouldn’t be confiscated easily’ etc. and we totally agree with it.

At that time, the problem with airdrops had been resolved permanently, even from the principle of double jeopardy.

Also, at the time of Prop 4, it was clear that our $JUNO could be used for future transactions. Every voter knew it clearly.

The essence of Prop 16 is “whether assets should be confiscated because the Juno whale holding more than the liquidity may pose a threat to the community in the future”

However, the same problem as the past has been submitted this time. The difference from the time of Prop4 is that Juno has grown as a big project, many transactions have been made in Osmosis, and we sold some Juno we owned as Wolfcontract claims.

In other words, Prop16 is not about whether there was a problem with airdrop once solved, but it is about ‘the whale who has more Juno than liquidity may pose a threat to the community in the future, and we should confiscate its assets or not.’

Wolfcontract’s points or any other members from community’s points on Twitter or Telegram are just like above.

In addition, Wolfcontract is trying to increase his supporters by claiming false propaganda.

First of all, most of Wolfcontract’s claims are exaggerated.

At first, our 1.5 million $JUNO, $60 million worth dump that Wolfcontract claimed on Twitter is exaggerated and incorrect. He overestimated the numbers, by using the word ‘Dump’ to spite and set us up intentionally.

https://twitter.com/wolfcontract/status/1502016980907442176

https://twitter.com/wolfcontract/status/1502035957201223683

As a matter of fact, it was not 1.5 million $JUNO worth. It was only 0.5 million $JUNO, 1 /3 of what is claimed. If you can recalculate the price to dollars using our selling price, it was only less than 8.5 million dollars, 1 /7 of what is claimed as 60 million dollars. Don’t trust, Verify!

(Moreover, we provided $2 million worth liquidity to Junowap pool right after its launch. https://www.mintscan.io/juno/txs/FC68456AE939A4A3202AEC4996B241502126A41340A83EB735014A4FDD7B28C5 )

In the case that we calculate the amount of our past cashout based on the current $JUNO price, it’s only less than 5% of our whole $JUNO.

Also, there is an expression as if it was once sold and dumped, causing serious damage to the market. But as we said in a direct message to the core team, we were actually selling only less than 1% slippage per day for these few months, while confirming the increase of liquidity so as not to destroy the market.

It is clear that Juno’s market hasn’t been destroyed in the last few months while we sold. On the other hand, prices keep rising on the market, which is obvious that we are not destroying the market.

If we were a malicious entity, why shouldn’t we’ve voted NoWithVeto in Prop4’s proposal and just sold all of them to avoid the risk like this?

We’ve never done anything like that. That’s because we care about the community.

In addition, he tweeted like this as of Prop4.

https://twitter.com/wolfcontract/status/1447932849101869056

Also, we should check out what Wolfcontract said on Telegram during October 7, 2021 to October 12, 2021.

Even though it is clear for him that we didn’t game fraudulently, he is still pointing us out as if we’re a dirty gamer in the Juno community repeatedly like below.

https://twitter.com/wolfcontract/status/1502039348799229959

https://twitter.com/wolfcontract/status/1501955971500883970

His remarks have no consistency at all, and this is obvious malicious propaganda with nasty harassment.

Also, the tweet here states that we have made it clear that we commit fraud, which is a big mistake.

https://twitter.com/wolfcontract/status/1502204616389320708

For your information, we are not good at English(We are asking someone who specializes in English to translate the text this time).

Therefore, we took the sentence ‘Let’s exit scam’ as the meaning of ‘eliminating scammers’ and we were really confused about the misunderstandings we made.

Do you really think a real scammer would say such a thing anyways?

There are some rumors that we are the owner of a Ponzi scheme.

https://twitter.com/wolfcontract/status/1502319180674174980

https://twitter.com/crosnest_com/status/1502367179802562572

https://twitter.com/wolfcontract/status/1502377253484777480

But it is completely out of the question. It is true that we have an affiliate system, but it is completely different from a pyramid scheme with an infinite chain.

We hate ludicrous MLM that makes victims for sure. So please do not confuse our service implementing scrupulously calculated incentives with other vulgar ponzi frauds.

The service started in May 2020 and ended in October 2021. No one has lost their properties. Since ATOM was still around $5, we were able to raise awareness of the potential of Cosmos and more than 30,000 people owned ATOM. Also, almost all of these 30,000 people increased their assets in us dollars.

We’ve never denied any user’s withdrawal requests and all of them have been processed without any problems. By reviewing the transfer history of this account, you can be sure that we are handling withdrawals sincerely.

https://www.mintscan.io/cosmos/account/cosmos1wz86dc3lyweg8slhf482vxy5ymd0t58ckpn3nq

Furthermore, there seems to be a claim that we are committing a fraud called “Telegram Farming”, which is just too ridiculous. Can you find any Txs of our Farming on Telegram? You can’t because we’ve never done like that.

Don’t trust, Verify. These claims are completely incorrect.

Is there a ponzi scheme in which nearly all users who participate increase their assets? We think never. Don’t be swayed by groundless rumors and it is definitely not the essential part of this discussion.

In the discussion criticizing us, some have pointed out that we’re just lucky to succeed only by taking advantage of Cosmos’s ability, meaning we didn’t play any roles to the community.

We think it’s not correct. We have held over 500 Meetups through our services in the year since May 2020 to educate the public about the potential of ATOM, increasing our advocates and buying over $100 million worth of ATOM on the market. It would be wrong to think that this has not had the slightest positive impact on the Ecosystem as a whole.

The name of DEBO stands for Decentralized Bonus Chain and we planned to create a chain that can eliminate scammers with a blockchain automatic reward payment system(Due to the allocation of resources to GAME project, this project idea is suspended now).

Juno core team made the falsification of some documents regarding the airdrop to justify their claims

They’ve made the falsification of the airdrop whale cap criteria recently to justify their claims.

This image is referred from Juno network guide. Only the statement “per address” is written as the whale cap criteria.

Moreover, as we can know from these URLs, there was not specific statement regarding the whale cap at 12:05 GMT, March 11, 2022.

https://twitter.com/2047isnow/status/1502370300628930564?s=20&t=hs4QcewdMrDgtdFOrjoWDA

Therefore, they’ve modified the whale cap criteria after submitting the Prop 16 to justify their claims. And many community members quote the modified information and claim that we have a fault.

As you can see in the following tweets, several people have mentioned the possibility of tampering, which was actually done.

https://twitter.com/sunnya97/status/1502371089493594112

https://twitter.com/JoeAbbey/status/1502353759686569986

It is import to be brave to say “No” if the core team is doing wrong things.

By the way, This is not us. It’s fake haha. https://twitter.com/juno_whale?s=20&t=dVMAfVXv_weCM-KEbdDitQ

We are not an entity to destroy Juno but a part of the Juno community members looking forward to its prosperity

Because of the huge expectations for Juno, we didn’t just sell every token we got from the airdrop but staked all of them instead.

As you can see from the past transactions, most of the sellings are completed only under the amount of the staking reward, and most of the staking reward are also restaked (The recent daily sellings are also less than 0.5% of the amount of our holdings. Among 279k $JUNO unbonded in February, the greater part, 259k $JUNO, was rebonded again considering the effect on the market).

Actions such as ‘Stake and sell a part of the reward’ and ‘Provide liquidity and sell a part of the reward’ are normal economic activities as well as for many people. If it is a problem to harm the community that the inflated currency spreads to the users and is sold in the market, shouldn’t we confiscate the asset of those who sell it regardless of the quantity(those who throw away the token in Wolfcontract word)? Then also, shouldn’t the team set a large inflation from the beginning?

Has the Juno community abandoned the significant ideology of permissionless? Do we even need the community’s permission to sell the reward we earn from the staking?

Is our selling based on the judgment that the price is too high for the liquidity in the short term going to destroy the ecosystem?

If we were trying to harm the community, we would have already sold all of our assets and drained liquidity, but we have never done anything like that.

In brief, we disagree with the undemocratic way of sacrificing justice to neglect the significant ideology of a blockchain.

Prop16 states that the following risks exist if whale’s assets are not confiscated:

1 High risk to on-chain governance (already has half of quorum) 2 Potential of buying validators with delegations in order to bribe them away from acting 3 Whale gamer can single handedly wipe out the entire DEX liquidity in 10 min or less (Should his funds be unbonded) 4 Fear in the community on a daily basis

These risks include those that are not even a risk at all and they can be completely solved other than confiscating the assets. We can totally discuss it in a more friendly way without the radical proposals like this time.

Let us explain it in order:

About 1 In the first place, we don’t own the majority of the quorum. Even if you have a majority of the quorum, it has no connection to the result of the proposal. Then the proposal that does not make any sense can be rejected by the community. Therefore this is not a risk.

About 2 This is a fundamental problem that exists in Proof of Stake, not just ours. Doing some problematic behaviors for the community will reduce the values of Juno we own as well, so there is no merit in cheating. This is also how Proof of Stake works in that balance in the community.

About 3 and 4 This would be the main agenda for Prop16.

Will VC and others be criticized when they join the community in the future? If simply having a large number of tokens poses a threat and they confront to be eliminated, the large investors won’t show up in this community for good.

Actually there are 178 accounts holding more than 50k $JUNO according to our quick research as of 3/12/2022. These numbers don’t include people who are worried about confiscation and are distributing their tokens to multiple addresses after Prop4, meaning the potential existence of large holders with splitted addresses.

There are some users with evidence of receiving airdrop on multiple accounts. Strict adherence to the proposal makes it appropriate to return the assets of such addresses to the community pool as well, and the line must be clearly delineated. It would be too violent to confiscate only our assets, despite the fact that this has not been discussed.

There is also the potential risk if holders sell just some part of their $JUNO and reduce the market capitalization greatly(In capitalism. it is common for stocks and so do cryptos as well).

At Juno-ATOM pool, the price of Juno will drop by 67% by the selling of only 5% of assets owned by large holders. The price will drop by 83% with 10% selling, and will drop by 98% with 50% selling compared to the current price.

The calculation of the price drop is written below.(In the case of 67 % price drop by the selling of only 5% of assets)

First, there are around 615,000 $JUNO and 880,000 $ATOM in Juno-ATOM pool on Osmosis.

At this time, The price of 1 $JUNO is 880,000÷615,000 ≒ 1.43 $ATOM

The amount of whale addresses here is defined as 178×50,000 = 8,900,000 $JUNO (178 accounts multiplied by 50,000 airdropped $Juno). This $Juno amount is the sum of airdropped $Juno to the whale addresses.

In this case, the product of both amounts is 541,200,000,000.

Then if 5% of their assets are sold, then 8,900,000×5% = 445,000 $JUNO will be added to the pool. Then the $JUNO amount in Juno-ATOM pool will be 615,000 + 445,000 = 1,060,000 $JUNO.

The product of pools in DEX is always the same until the liquidity providing, then ATOM amount will be 541,200,000,000÷1,060,000 ≒ 510,000 $ATOM.

At this time, the price of 1 $JUNO will be 510,000÷1,060,000 = 0.48 $ATOM

This means that the $JUNO price drops by 67%.

In the same process, drop % of each cases can be calculated.

Compared to the Osmo-ATOM pool, the Juno-ATOM pool is overwhelmingly lacking in liquidity, so there is more possibility of risks.

Do the community members really understand these potential risks?

However, aside from their risks, if our entity could be potential fear to the community in the aspect of draining liquidity or destroying the market, we would like to offer the proposal as follows:

Stake all Juno we own forever. Sell the reward and if we change it to another tokens, we have to provide liquidity to Junowap with that token pair. Also, we can’t unbond the liquidity for 2 years from now.

Ex: Get 10000$JUNO rewards→ Sell 5000$JUNO Buy ATOM ( holding 5000$JUNO: 5000$ATOM) → Add all of them to JunoSwap Liquidity

Just in case we don’t follow the rule above(Unbond the liquidity/ don’t provide liquidity) just in case, we’re willing to accept the Juno chain update to slash our account balance like the proposal this time.

Juno https://www.mintscan.io/juno/account/juno1s33zct2zhhaf60x4a90cpe9yquw99jj0zen8pt Osmo https://www.mintscan.io/osmosis/account/osmo1s33zct2zhhaf60x4a90cpe9yquw99jj0usrvs9 Atom https://www.mintscan.io/cosmos/account/cosmos1s33zct2zhhaf60x4a90cpe9yquw99jj05tsuxh Terra https://finder.terra.money/mainnet/address/terra1s33zct2zhhaf60x4a90cpe9yquw99jj0j02uyh

Juno core team member’s address link above holds the amount of 580k $JUNO.

This account is used to regularly send Juno to Osmosis by IBC Transfer and sell it on Osmosis. It seems that some of the sold tokens are provided to liquidity, but as far as we analyze, they have converted Juno into UST and many of them are managed on Luna.

Wouldn’t such whales’ accounts make potential fear for the whole community? Most of the liquidity will be drained if they sell their token.

If it’s acceptable to provide some of the yields from selling into the liquidity, our suggestions should be accepted as solutions.

We wonder why there is no discussion on how to solve the problems other than confiscation. It is extremely disappointing if there’s only emotional arguments just intending to persecute those who have a large quantity of tokens.

Is it possible to deprive someone of his or her individual asset if it benefits the general public? It never should be.

As we say for many times, since the problem is related to airdrop has been solved in Prop4, the problem we discuss this time is ‘whether or not the assets of the address with large holdings amount should be confiscated’

Of course, the answer is ‘NO’.

We hope you understand that our clients and us are also a part of the Juno community.

Did we do anything wrong that deserved asset confiscation? At least we have never done anything like making war.

The biggest and fundamental problem with Prop 16 this time is that it creates an incentive to seize our assets, regardless of whether we are right or wrong.

For users, there is a tremendous incentive to vote yes and eliminate the whales, to reduce the amount of tokens circulating now and might be sold in the future.

This is a significant deviation from ethical and moral governance in the community.

This Prop 16 will be a page in blockchain history.

Will it create a precedent that the masses in a decentralized ecosystem are much scarier than the problems caused by a centralized administrator? Will moral and ethical governance be properly conducted?

It will be a big experiment to test the limits of blockchain.

Also, if Juno is a community that passes the Prop 16 without careful discussion, Juno will end up being a toy for the DeFi craze.

We’d like all the community members to think carefully and calmly.

2.5M Juno allocated for official delegation program and Juno managed by the core team should be used to vote least Abstain

In the first place, the ‘YES’ votes in Prop16 includes most of the 2.5millions $JUNO of the delegate program managed by the core team.

https://www.mintscan.io/juno/account/juno190g5j8aszqhvtg7cprmev8xcxs6csra7xnk3n3

If you vote for ‘NO’, which is opposite to Wolfcontract, there’s a possibility that the core team will block your opinion and they can deliberately reject you in a future delegate program. This is going to make validators suppress their own opinions and vote to ‘YES’ safely.

In order to maintain neutrality of the core team, we think that it is necessary to make 2.5millions Juno which was assigned to the delegate program turn to abstain and we should tackle this problem from a neutral position, not from a biased standpoint.

Therefore, the following 4 accounts below should change their votes from ‘YES’ to ‘Abstain’. This is nothing but a behavior significantly lacking the neutrality of the core team in the community.

https://www.mintscan.io/juno/account/juno1a8u47ggy964tv9trjxfjcldutau5ls705djqyu https://www.mintscan.io/juno/account/juno17py8gfneaam64vt9kaec0fseqwxvkq0flmsmhg https://www.mintscan.io/juno/account/juno130mdu9a0etmeuw52qfxk73pn0ga6gawk4k539x https://www.mintscan.io/juno/account/juno1s33zct2zhhaf60x4a90cpe9yquw99jj0zen8pt

The 2.5million $JUNO which are delegated by delegation program plus Juno in the the 4 accounts above are in a total up to 4.1million $JUNO which have been voted to ‘YES’ by the core team.

We’ll vote Abstain to declare our neutrality to Prop 16 because we’re in the middle of things. We hope the proper correspondence of the core team. We should be gentlemen.

We’ve voted Abstain for Prop 16 to keep the governance neutrality.

Our proposal to the community is Stake all Juno we own forever. Sell the reward and if we change it to another tokens, we have to provide liquidity to Junowap with that token pair. Also, we can’t unbond the liquidity for 2 years from now.

This can not only prevent the short-term rapid dump caused by the whale, but also increase the liquidity of Junowap.

We believe our proposal is following justice.

Before submitting the hostile Prop, why didn’t we look for a peaceful solution that everyone can be convinced of?

We would like everyone to have this discussion carefully for a longer period. Once you have voted, you can re-vote if your opinion changes. If you are voting YES with an easy mind, we hope that you will take into account our arguments and act according to your conscience and the ideology of the blockchain after careful consideration.